A Christian's Guide to Budgeting

Do you know where your money goes every month? Understanding your personal cash flow will help simplify your financial decisions. No matter what your income is, it’s important to know where your money is going to ensure that you are stewarding your finances well and making wise decisions.

The best way to review your cashflow is to create a budget. Budgets can be boring, but this Live, Give, Owe, Grow (LGOG) budget is simple and easy to implement. And the best part is, it’s all from a biblical perspective.

What Is Cash Flow?

Cash flow refers to your income minus expenses. Reviewing your cash flow on a monthly basis will help you evaluate your current financial situation and make better decisions when it comes to living, giving and saving.

An Ideal Budget

When money comes in and goes out, there’s only 5 places it can go. These are the 5 short-term uses of money: Live, Give, Owe-Taxes, Owe-Debt, Grow (LGOG). These 5 short-term uses of money make up our recommended budget categories.

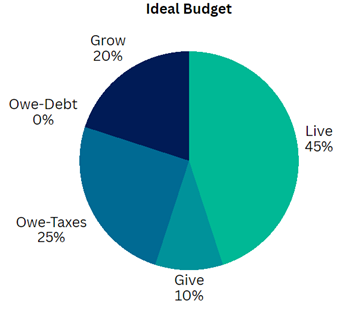

How much income should be allocated to each category? Let’s dive into an ideal budget.

It’s important to note that every person’s financial situation is unique. Your initial budget may look different than this one, and that is okay. This framework is designed to help you see where your money is going currently, and then make a plan to move toward biblical money management principles.

Live – 45%

Living expenses consume the largest chunk of our income, making lifestyle the most significant use of money. Living expenses include housing expenses, food and groceries, transportation, health care, travel, child expenses, clothes, fun money and all other miscellaneous expenses.

The average household spends 50-70% of their income on lifestyle. When you can keep your living expenses below 50%, you will make room to meet savings and giving goals. Our culture today is used to getting things immediately, which makes saving and giving goals more challenging. One way to overcome this challenge is to automate your giving and savings. An easy way to do this is to have your cash flow order prioritized correctly.

Cash Flow Order

Most people prioritize lifestyle over giving and saving. As a result, giving and savings get little to no allocations in the budget at the end of each month. Here is what a typical, secular, cash flow order looks like compared to an ideal, biblically prioritized cash flow order.

In order to avoid a cash flow deficit and neglecting your giving and savings goals, prioritize them ahead of living expenses first and spend what’s left over on lifestyle.

Housing

A lot of people get caught up on the $3 expenses like, “Can I afford a latte?” or “Should I get guacamole at Chipotle?” But what really matters is the $30,000 questions like, “Where should I live?” A good rule of thumb for housing is no more than 15-20% of your household gross income. If you own a home, this includes your mortgage, insurance and property taxes. If you rent, this would just be your rent payment.

So many people buy too much house, causing them to feel unhappy in other areas of their life because they don’t have enough money left over to meet their savings goals or do things they enjoy doing such as travel and activities with their family. Committing to 20% or less for all housing expenses helps to avoid being “house poor” and gives you a lot more flexibility in your budget.

Give – 10%

While 10% is a great place to start with your giving, we encourage you to prayerfully consider how much of your income you should be giving. When you give, you experience true financial freedom because your heart is with God and not your money. Some of us are called to give well above 10% of our income while others are just staring their giving journey and may give less initially and build up from there.

Tithes vs. Offerings

A tithe is a specific amount, like 10% for your income, that you give first. An offering is anything extra that you give beyond that. The point of tithing to your local church is to put God first and give up complete control over where the funds are going. The Bible tells us that tithing to your local church is away to show that we Trust God with our lives and finances, and that we will be blessed for being obedient with our tithing. In fact, God specifically asks us to put him to the test!

Debt Repayment or Give?

As a Christian, it’s best to give as your first priority and trust that God will provide for all other expenses, including debt repayments. Maybe you can only give1-2% initially instead of 10%. We encourage you to pray and ask God how much He thinks you should be giving, and give that first before any debt repayments.

Spousal Unity

It’s important that you and your spouse are aligned on your giving and your budget. God is more interested in your marriage than he is your money. Don’t become rigid and legalistic in terms of your giving. Focus more on reaching agreement with your spouse than the number of dollars you are giving. As you experience God's blessing through giving, we are confident both of you will increase your giving over time.

Owe-Taxes – 25%

The amount of taxes owed varies greatly for each household, but most people pay around 25% of their income to federal, state and payroll taxes. While there are important tax planning strategies that financial advisors can help you implement to optimize your future tax rates, it’s important to note that by and large, your tax rate is out of your control if you are a non business owner.

As hard as it is sometimes to see a huge chunk of money go to the government, it’s important to remember that taxes are symptomatic of God’s provision. Taxes should be paid with integrity and thanksgiving because paying taxes recognizes God’s provision and honors authority.

Owe-Debt – 0%

The Bible warns against debt in Proverbs 22:7 where it says, “The rich rules over the poor and the borrower becomes the lender’s slave.”

Borrowing always presumes on the future. If you have high interest debt payments that you are making each month, you will have to submit yourself to a lower standard of living in order to make those payments. Debt always limits you to a lower standard of living.

Consumer Debt

You should work towards having 0% of debt in your budget. If you do have debt payments, you can use either the Debt Snowball or Debt Avalanche methods to eliminate your debt.

The Debt Snowball is where you pay extra on the smallest debt balance and continue until all debts are paid off.

The Debt Avalanche is where you pay extra on the debit with the highest interest rate, and continue until all debts are paid off.

Which method is best to use?

Whatever method motivates you most. The Debt Snowball may emotionally feel better as you can reduce the total number of outstanding debts more quickly. The Debt Avalanche works best if you are focused more on the mathematical best debt elimination technique.

Consumer debt that should be avoided or paid off as quickly as possible includes:

Credit card debt

Auto loans

Student loans

To learn more about the economic, psychological and spiritual implications of debt, check out our 5 Biblical Money Principles blog.

Grow – 20%

The only way to reach long-term goals is to grow your saving and investing. Getting to a savings rate of at least 20% will completely change your life and your ability to achieve financial independence. Where should you save first? Here is the exact order that we recommend.

Savings Hierarchy

1) Eliminate all high interest and short-term debt

If you have any credit card debt or consumer debt, paying it off should be your first priority. When you no longer have to pay debt payments, you increase your ability to save for the future.

2) Create an emergency fund

Consider having at least 3-6 months of living expenses for your emergency fund. If you are single, aim for a minimum of 6 months. If you are married and both spouses are working and have stable jobs, aim for a minimum of 3 months.

3) Save for major purchases

If you want to buy a new car, house, furniture or any other major purchase, you will want to save up for the major purchase(s). This will help you avoid taking on any future debt to fund the purchase.

4) Invest

Here is where you can start to diversify your savings by investing in low cost, passive index funds to meet your long-term goals. Investing should not be sexy. It should be boring and consistent. Long-term goals may include retirement, education funding for kids, financial independence, or lifestyle changes.

5) Risk taking

If you have completed steps 1-4, you may be ready to take on more risk through ways like starting a business, investing in riskier assets, buying real estate, etc. Note, many people will get to step 4 and remain there, and that's just fine. This step is certainly optional and typically desired by those with an entrepreneurial spirit.

Budgeting Software

In order to see where you are falling within these recommended budget categories, we highly recommend using a budgeting software, specifically one with an envelope system that can allocate future dollars. Tracking your expenses, even if it’s just for a couple of months, will help bring a lot of clarity to your budget and help you identify changes you should make to optimize your finances.

Our favorite budgeting apps are:

Having regular budget meetings with your spouse, each time you get paid, to review and discuss income, expenses and account balances will help you be intentional with finance conversations and keep you on track to accomplishing your dreams.

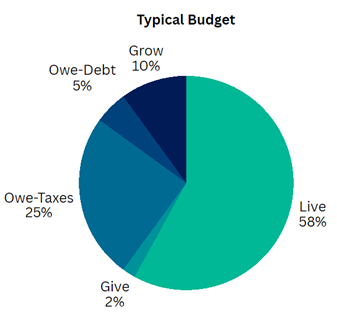

Typical Vs. Ideal Budget

Here is a typical budget that we see when we review a new client’s cash flow compared to an example of an ideal Christian’s budget. As you can see, the typical person is spending a lot on lifestyle, has some debt, is under saving and not prioritizing giving. This "keeping up with the Jones" mentality, while fun now, comes at a very high cost in the future. The typical budget lacks financial contentment in the present and lowers financial confidence for the future. But most importantly, the typical budget does not honor God by putting Him first in your finances, and therefore, you may be missing the fullness of what God has called you to do in your life and in the lives of others.

Need Help?

If you are in one of the following situations, it may make sense to reach out:

You don’t know how to get from your current budget to the ideal budget.

You don’t have time to analyze and optimize your financial situation.

You want an accountability partner to help you accomplish your goals.

Free Financial Assessment

Schedule an intro call to receive a FREE financial roadmap here.

A free financial assessment consists of:

Reviewing & analyzing your most recent tax return, investment statements and current financial situation.

Giving you recommendations for you and your family to consider.

We would love to chat!